Consumer Loans

Whatever your financial need, First Federal Bank has personal loans for almost any purpose. We offer secured and unsecured programs with a variety of terms and rates. Whether you are looking to buy a new vehicle, have unexpected expenses, wish to consolidate your debt or want take a family vacation we can help find a loan that’s right for you.

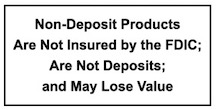

All loans are subject to credit approval. Rates may vary with amount financed, term and credit history. Other requirements may apply. Please see account disclosure for applicable fees and terms and a complete description of any account. Account disclosures are available at any branch location. Please see a banker for details.

Overdraft Line of Credit

We will lend you the funds to cover any overdrafts in your First Federal Bank checking account, ensuring you have no bounced checks, missed payments or denied debit card transactions.

- Fixed initial term that auto renews annually thereafter

- Funds are automatically transferred to your checking account

- Variable interest rate

Consumer Loan – Unsecured

Debt Consolidation, Home Improvement Projects, Education Expenses … it’s your choice.

- Competitive rates and payment terms

- No prepayment penalties

Chat

Chat